Recently I spoke with a young woman who is doing the right thing by investing in her 401k early. She’s in her early 20s and that sets her up for the magic of compound interest. I really wish someone had told me how little I’d have to invest at a super young age to add 7 figures to my eventual nest egg. My big concern for her was that I asked “Do you know what is in your account currently?” She said that she had no idea and that she just ticked the box with her employer.

UH OH!

That’s not an atypical response. But did you know that her money might not actually be invested? When you open a retirement or investment account, you need to make sure that it’s not sitting in a cash account. Yes, brokerage firms have cash accounts that make very little interest. It’s usually for holding money pending the purchase of a fund. So how does this happen to very smart people? They get confused and figure that everything is on autopilot.

So if you don’t know where your money is, it’s time to dig in (at least a little bit).

- What funds am I invested in?

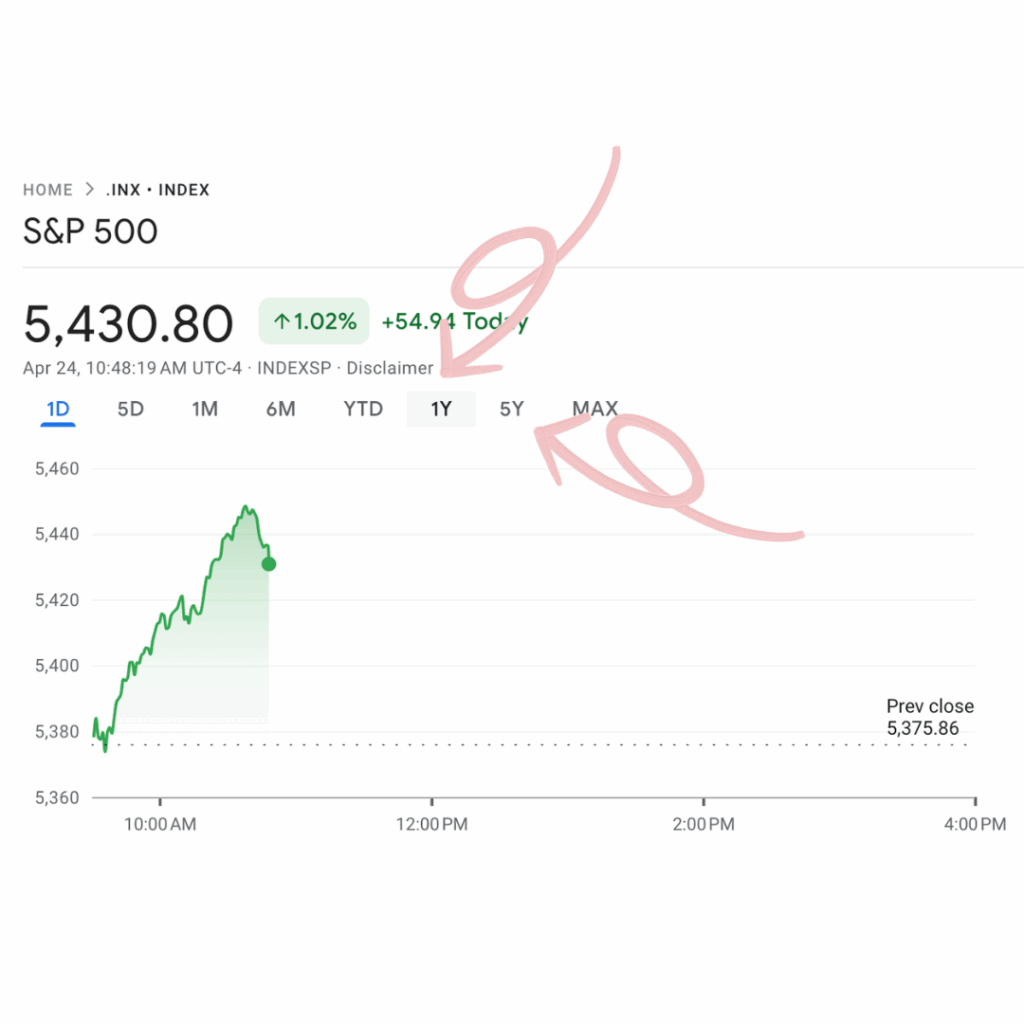

- Do they perform at least as well as the S&P 500? Just look at the percentages for 1 year and 5 year. Don’t worry about “points.”

- Do I have a choice of funds to invest? You can ask HR about this.

As a rule of thumb, when you’re investing… 15% of your income will get you to a comfortable retirement as long as you’ve got a few decades on your side. So let’s say you’re going to invest 15% of your $100,000 household income. Where do we put it? There’s a hierarchy.

Employer match: This immediately doubles your money (woohoo!). Choice between ROTH and traditional match? Choose ROTH for the tax benefits.

Roth IRA: this means you’re putting in money after you’ve paid income taxes, so you won’t pay taxes when you take money out after age 59.5.

Traditional IRA: this means you’ll pay income taxes on your withdrawals

See why this matters?

Let’s say you put away $1250/month for 40 years. Yes, that sounds like a lot, but I’ve seen car payments that high for two-person households. But look at the return at 10%!

A lot of people adjust for inflation so they calculate it at 7%. But that doesn’t take into account that you’ll likely get raises to match inflation (at least) and your investable income will go up. Either way, nearly $8m is a comfortable nest egg by any measure… and that’s if you never earn more than $100,000 as a household and don’t even start until age 27. Worst case at 7% is over $3m. Feel free to play with some numbers here.

So your homework tonight is to at least see where your money is invested. Then maybe for fun, plug it in the calculator I linked. Because if you’re just “saving” you’ll have $600,000 instead of $7,305,100. That’s an expensive oversight.

Cheers!

Leslie