There’s a lot of panic in the market because of the tariff policy announced by Trump yesterday. I will not go into politics or opinions on that because I am not an economist. I’m just a middle aged lady who “lost” a chunk of retirement & investments yesterday. My family lost enough that we could have bought a minivan with it. So what were my options?

a) Sell off some shares to put it in gold or cash or stash under the mattress

b) Do nothing

c) Buy more shares

My husband and I have a little extra cash on hand, so we went ahead with C! Now that’s not the right answer for everyone. We just believe in investments being a long game not a short-term gamble. And I happen to consider a dip in the market to mean the shares are on red-line sale. I’m going to preface the article by saying I am not a broker, and advisor, economist or CPA giving financial advice. I’m explaining what I can so you can make an informed decision and help you have some peace.

The market can be confusing. It’s a graph that looks like an ekg readout. People talk about points (I still don’t know/care what that means). The headlines are always so dramatic because no one wants to say, “The stocks are down today, but overall everything is fine.”

My dad, Dan Wheeler, was a finance guy and a leader at Dimensional Fund Advisors. He had a decades-long career touting the benefits of passive investing in mutual funds with flat fee advisors. Did I lose you? Hang with me. I went to one of his talks and literally the only thing that stuck with me is “The market is a roller coaster, but strap in for the whole ride because the only people who die are the ones who jump off in the middle.” That’s an easy thing to remember right?

Here’s the big scary bright red rollercoaster dip over the last 5 days! Eek! 5% is a LOT! Let panic ensue. Actually don’t.

Okay, well, that one didn’t feel good… so how about this one with 5 years of data instead of 5 days. Ooooh look, this one says investments more than doubled with some dips and climbs. Phew.

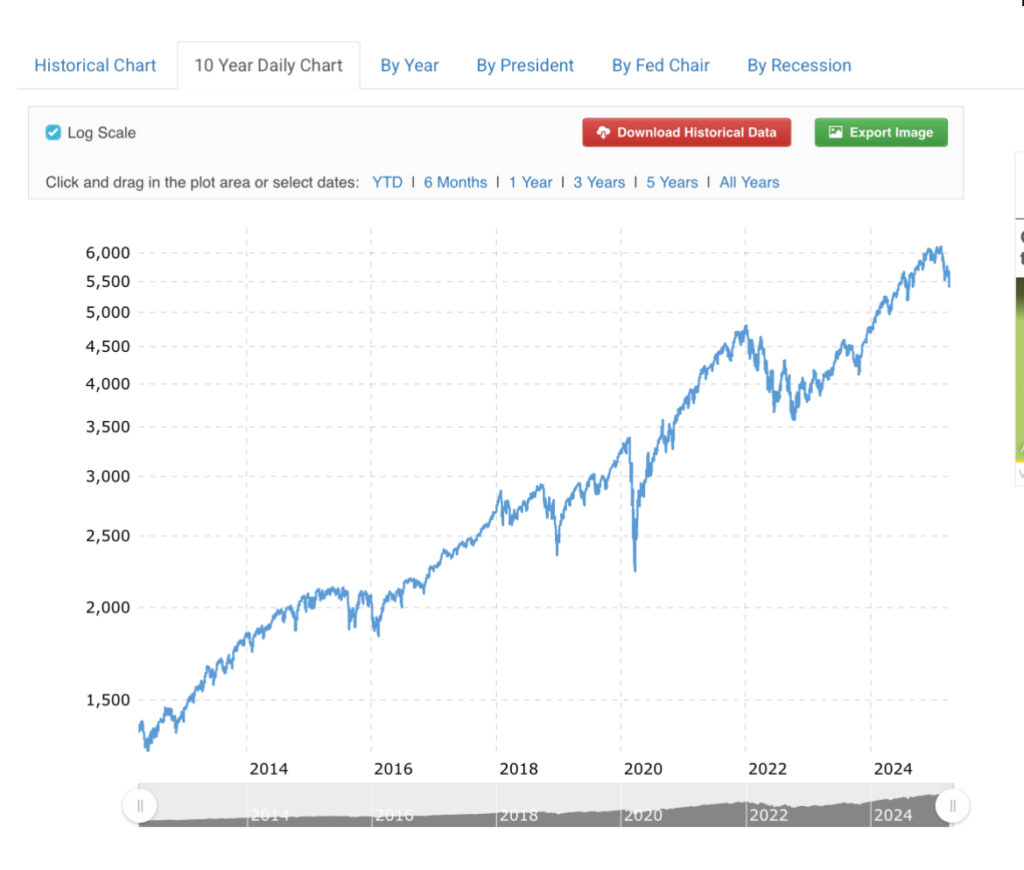

Okay now how about this one. This is the S&P 500 over the last 10 years. Some big dips, but overall an increase by about 200% That means tripling your money! Now that’s not scary at all!

Investing is a lifestyle change, not a get rich quick scheme.

I am not a CPA. I am not a financial advisor. I make no promises and give no advice. I’m a money coach telling you how to interpret the data and make a decision right for you.